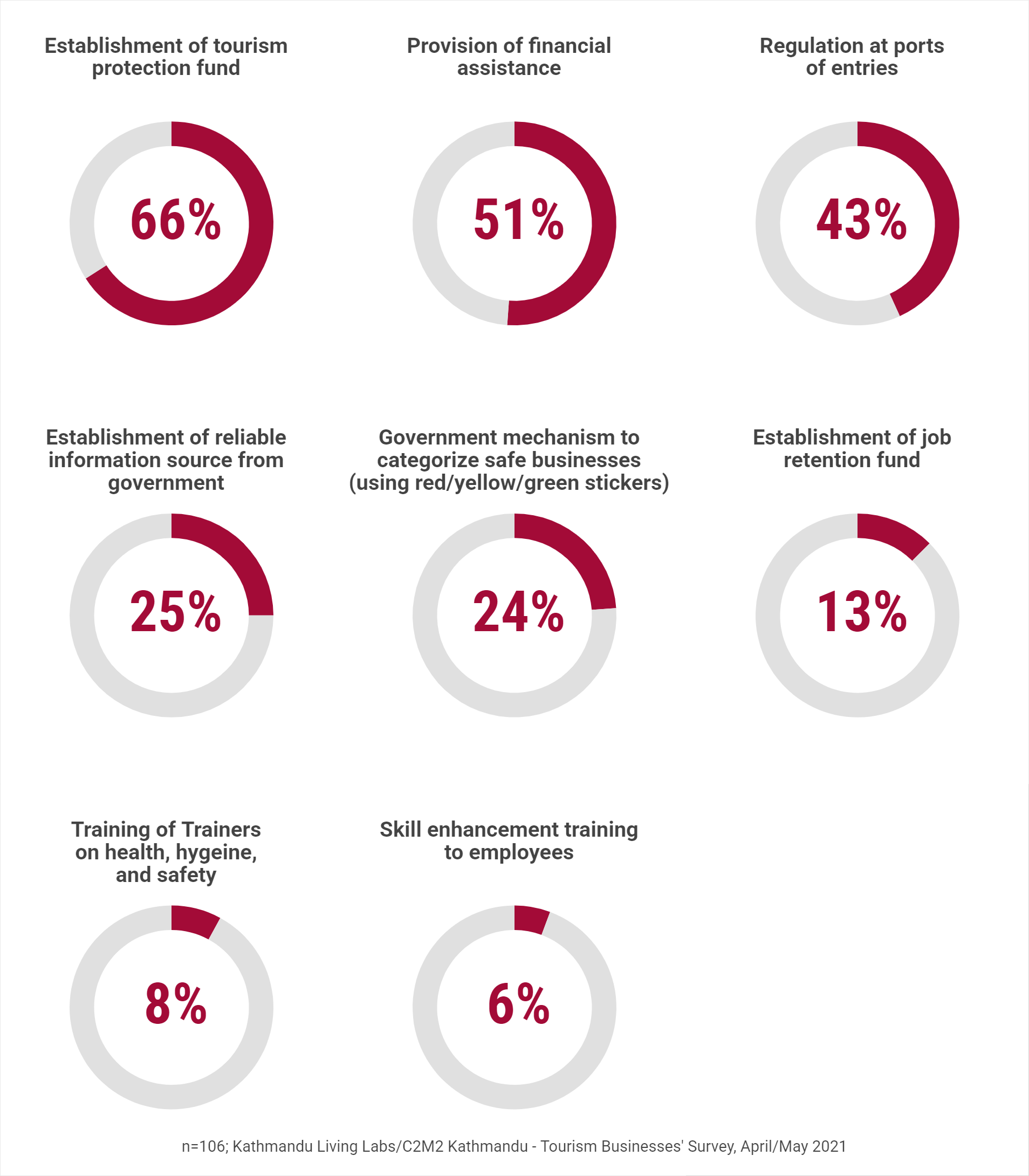

When we asked the 106 Kathmandu-based tourism entrepreneurs who took part in our tourism business survey about the kind of policy support that would help them recover from the pandemic, here’s what they said:

Respondents could select more than one answer for this question. Each pie chart represents the percentage of respondents that choose a given option.

Unsurprisingly, the two most popular answers deal with financial assistance needed to support the economic recovery of tourism businesses. The third popular answer – “regulation at port of entries” – is driven by the need for improving mechanisms for enhancing tourism mobility in the region.

UNDERSTANDING TOURISM BUSINESSES’ NEED FOR FINANCIAL ASSISTANCE

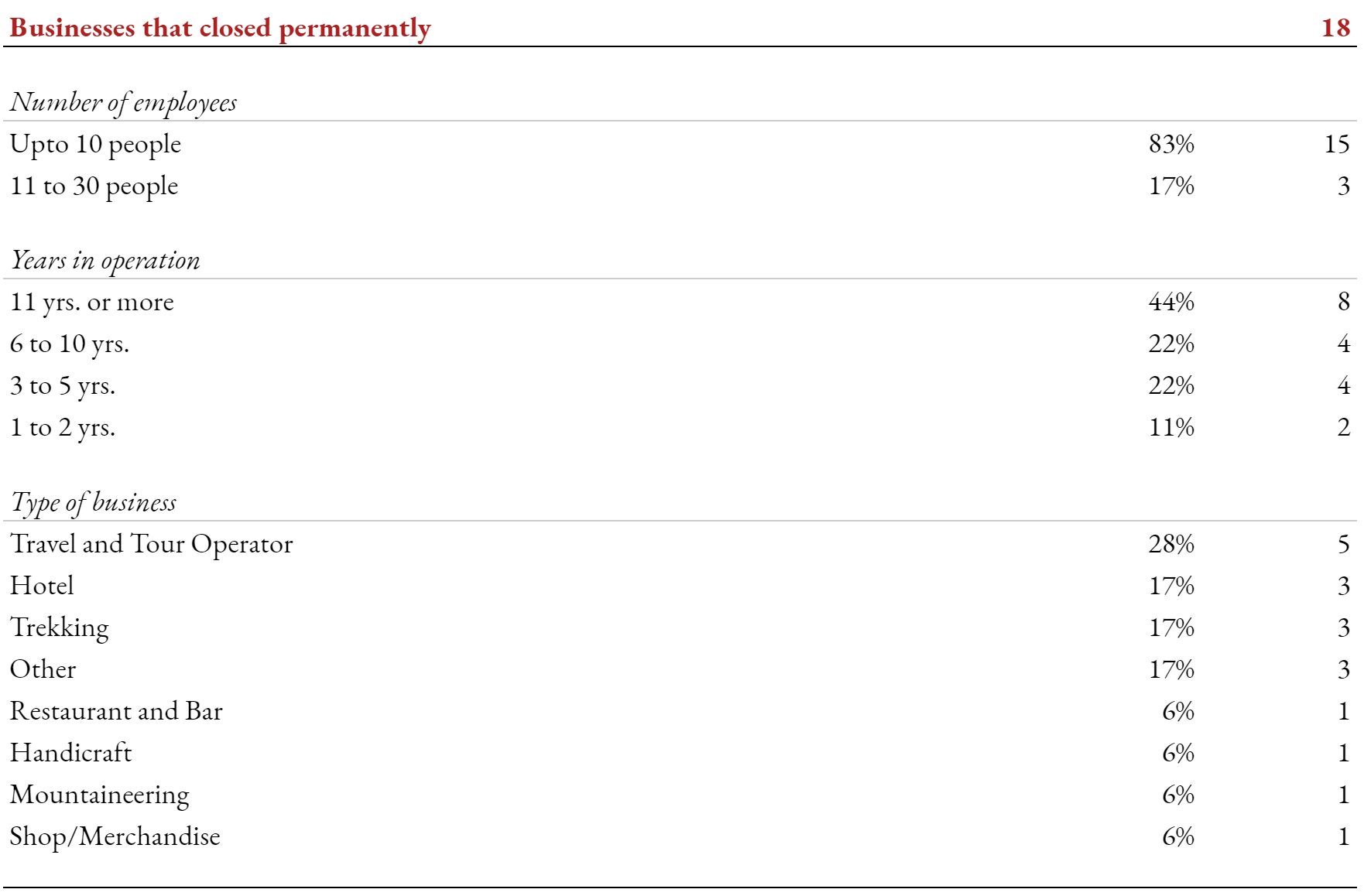

According to our survey respondents, the pandemic has indeed been disproportionately harsh to the tourism sector: 18 of our respondents – nearly one out of every five – reported their businesses having to shut down permanently during the pandemic. Table below shows more details around these businesses.

With the country being closed to tourists for more than a year Silent squares , Giacomo D’orlando, Himal Southasian, April 2020 , small to medium-sized businessesMost of the respondents in our survey were small and medium-sized businesses (based on staff size) operating in the travel or accommodation segment were among the worst hit.

What’s worse is the fact that 66% (nearly 2 out of every 3) businesses that closed had been in operation for at last 6 years or more. They had survived the 2015 earthquake, even the economic blockade that followed. They couldn’t, however, survive the pandemic.

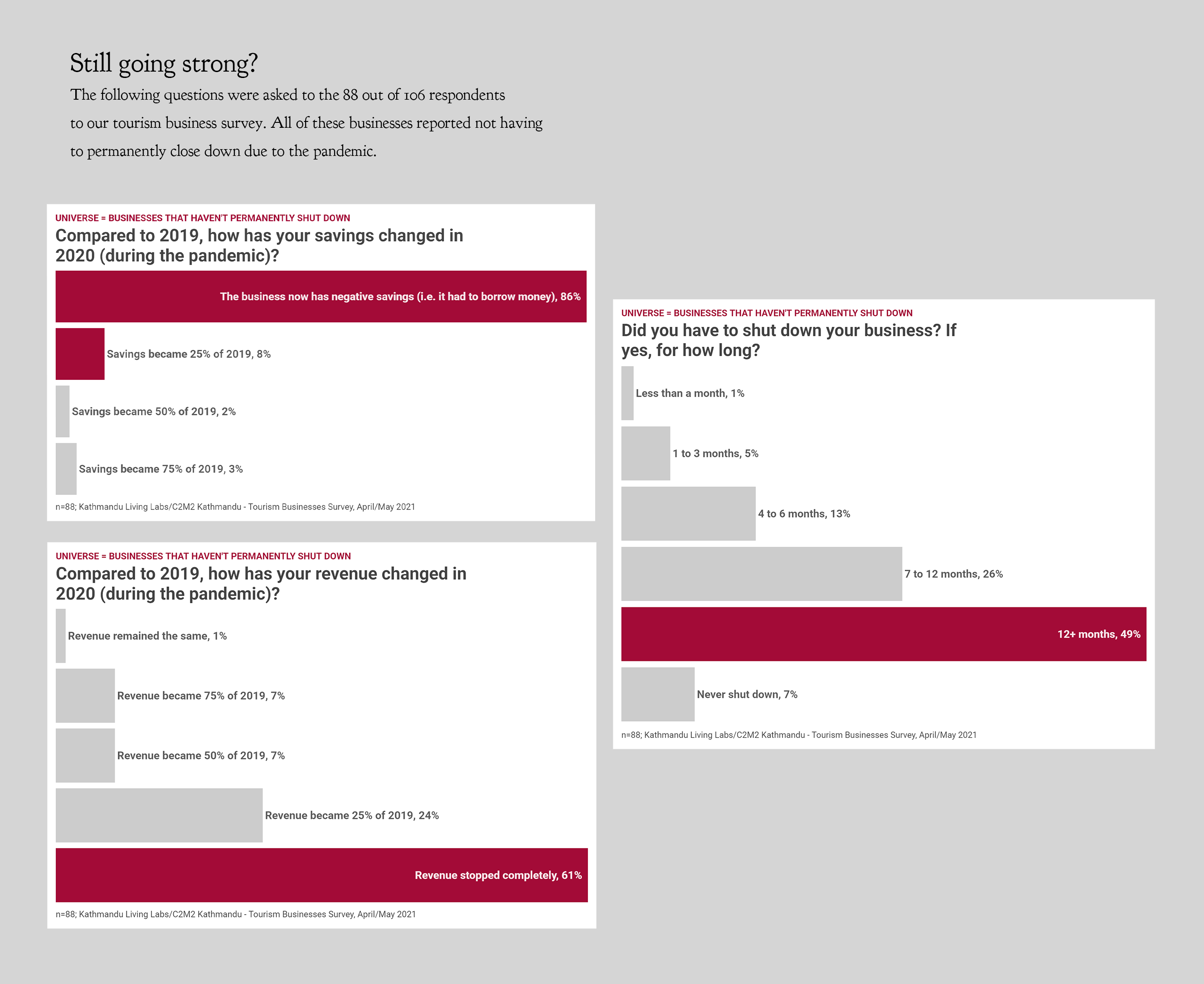

EVEN THOSE WHO SURVIVED ARE BARELY functioning

For the remaining 82 businesses that did manage to pull through, the situation doesn’t look very promising either. As we can see in the charts below, savings have dried up, with a whooping 86% reporting negative savings. And, nearly half of our “survivor” businesses are only just reopening after having temporarily shut down operations for at least a year.

THE NEXT SIX MONTHS

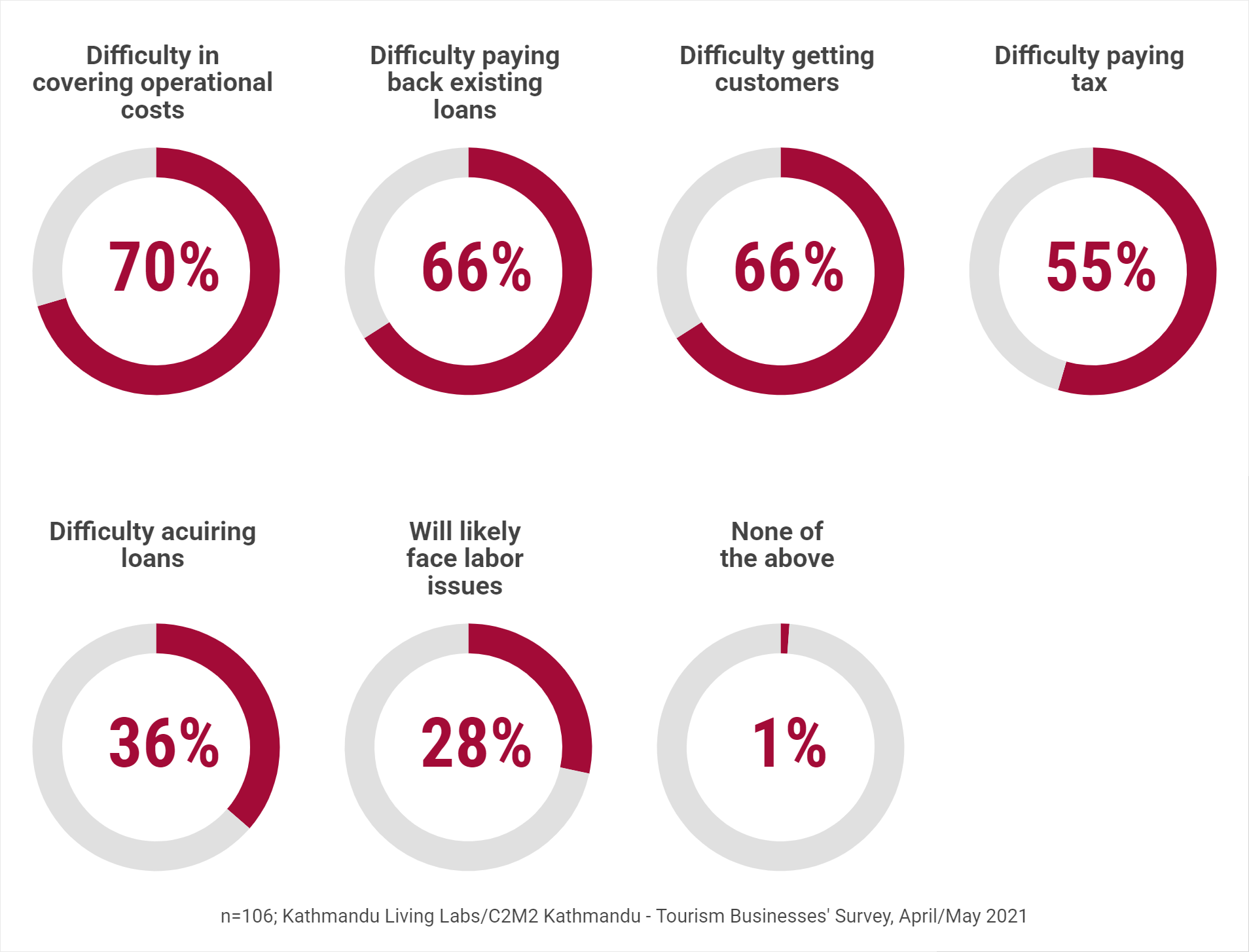

The present reality of currently operational tourism businesses seems to align closely with these businesses’ outlook regarding their respective futures. Chart below shows the different kinds of problems our respondents reported they are likely to face in the next six months.

Respondents could select more than one answer for this question. Each pie chart represents the percentage of respondents that choose a given option.

As we can see, dwindling savings, near-zero revenues, and lack of customers have placed doubts about the survival of the 4 in 5 business who have somehow managed to stay afloat through the pandemic. With seven in ten businesses worried about not being able to gather funds required to keep their businesses running, and more than six out of ten businesses worried about not being able to meet their existing financial obligations, the situation is very alarming.

In fact, it could have already gotten much worse, given the fact that our survey was filled right before the second wave of COVID-19 hit Nepal.

WHAT MEASURES CAN BE TAKEN?

PROVIDE SUPPORT FOR BUSINESSES TO COPE WITH PILING OPERATIONAL COSTS

7 in every 10 respondents that are currently operational (i.e. not permanently closed due to the pandemic) cite “covering operational costs” as their biggest worries for the next six months.

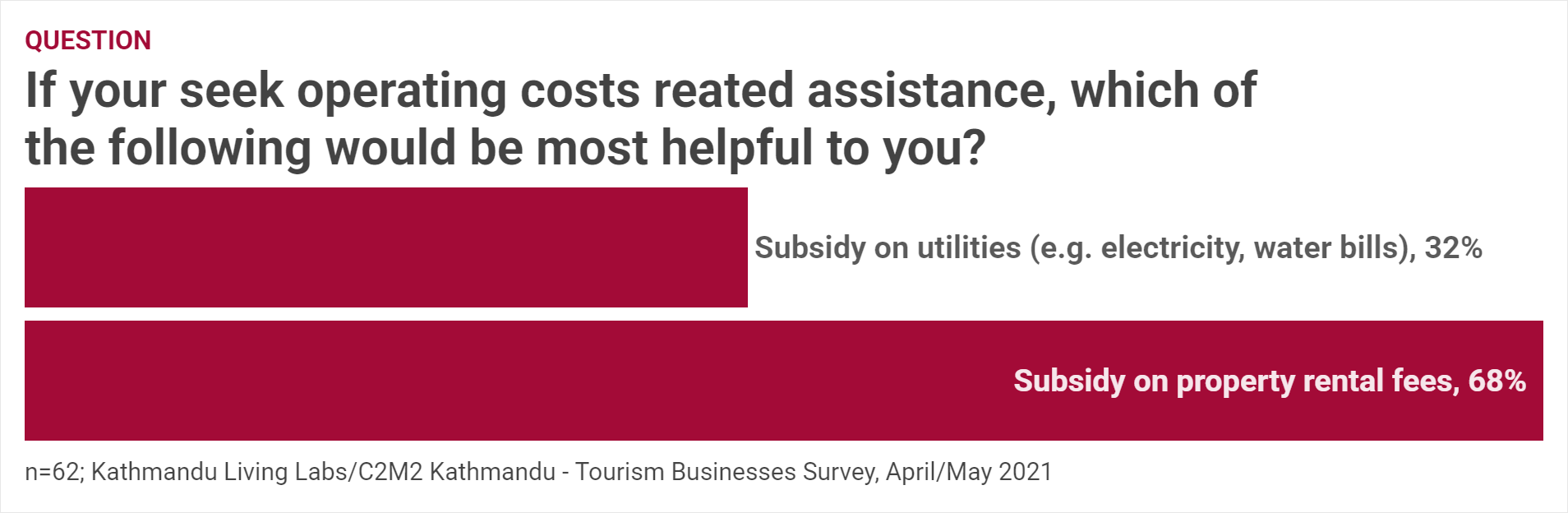

When we asked the 62 respondents who mentioned operational costs as one of their concerns about the kind of support they would need, here’s what they said:

Providing subsidies and negotiation support on payment of rents and utility bills could help these businesses stay alive for longer.

MAKE LOAN REPAYMENTS EASIER

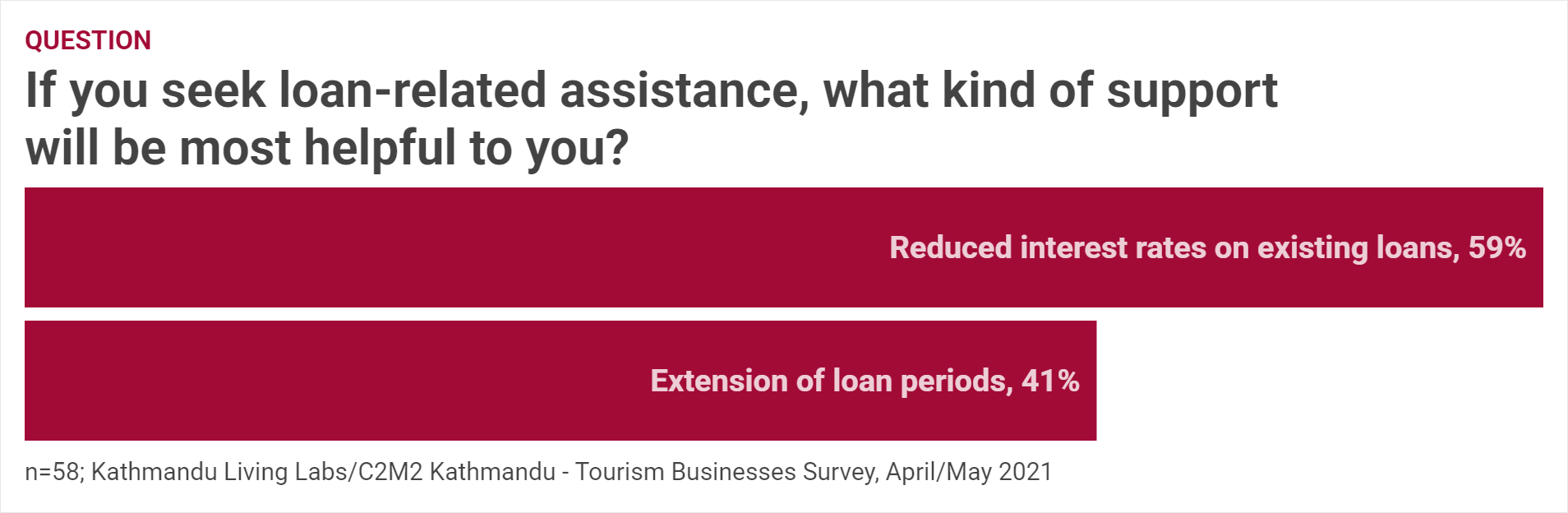

2 out of every 3 businesses that are currently operational (i.e. not permanently closed due to the pandemic) reported concern about not being able to repay their existing loans. We asked these 58 respondents about the kind of assistance that would be most helpful to them in repaying loans, here’s what they replied.

It appears there is no single preference amongst our respondents, with “reduced interest rates in existing” being more popular over the “extension of loan periods”.

While further analysis could help reveal what the right intervention is for businesses belonging to different segments (hospitality, adventure, etc.), of different sizes, or of different financial, it is clear that there is a need for mechanisms – like the ones mentioned above – that would make pre-existing financial burdens a little easier to manage for businesses in the tourism industry.

REDUCE TAX BURDENS

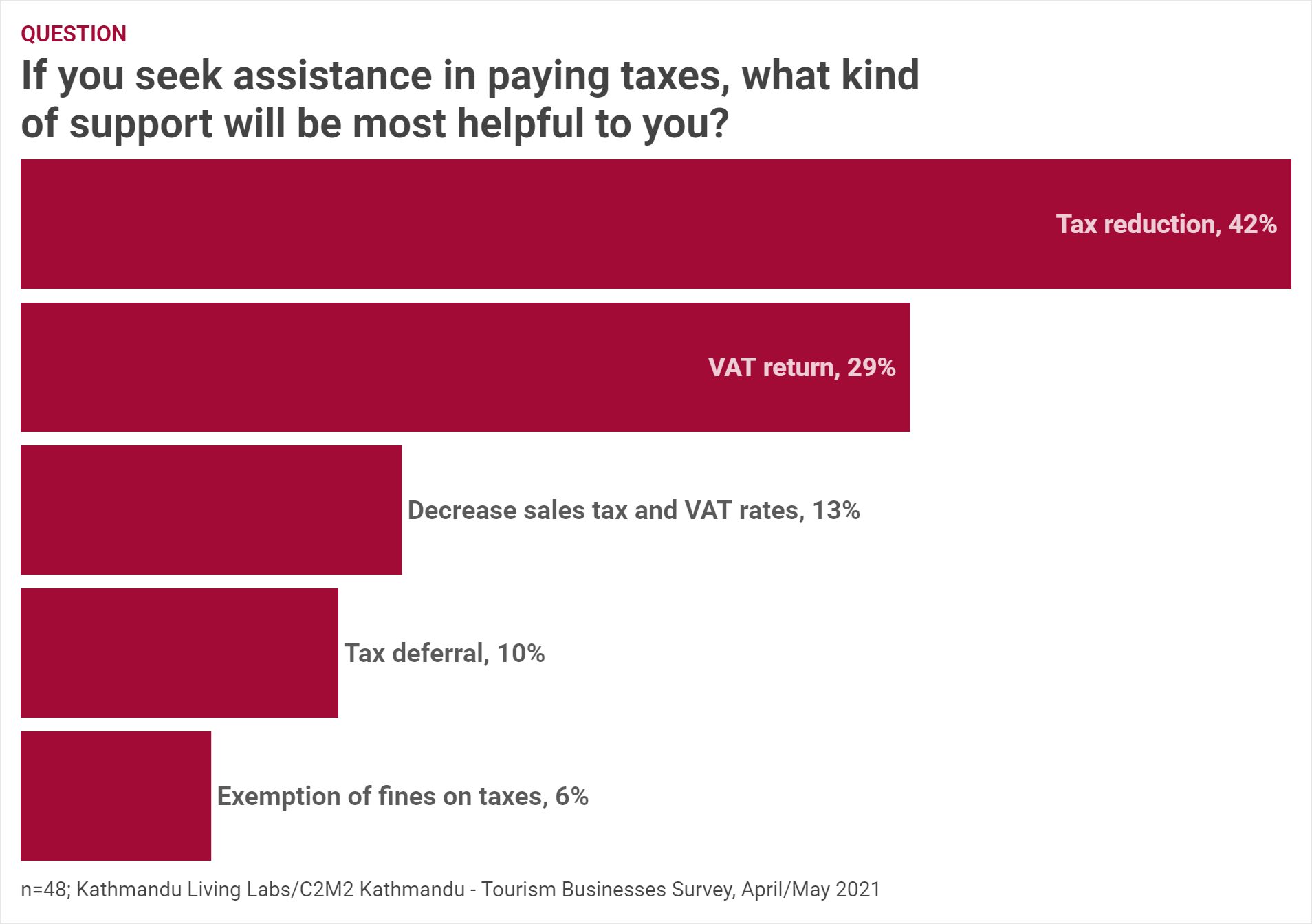

Providing support in tax, through mesures such as direct tax reduction, VAT return, or tax deferral could be useful. In this note, the 48 respondents who cited “paying tax” as a concern made the following choices when asked about the kind of tax assistance they would need.

The above chart gives some indication of what businesses’ would prefer. However, further study might be warranted to identify the right kind of intervention for businesses on the basis of segment, size, and other characteristics.

EASE BORROWING

More than 1 in every 3 of our respondents report that they will have difficulty in acquiring loans over the next six months.

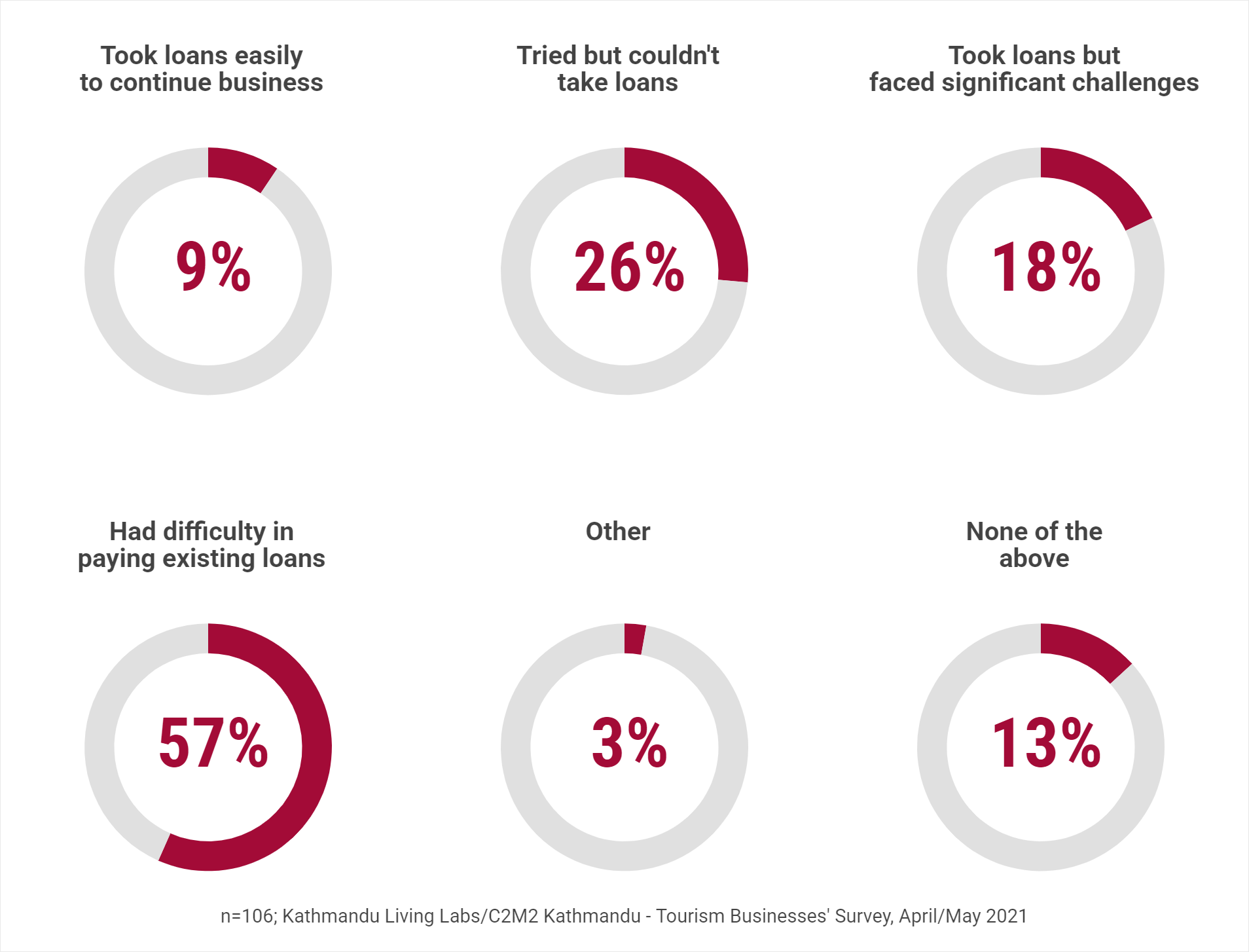

Our in-person interviews with tourism entrepreneurs revealed that issues such lack of necessary collateral needed by small and medium-sized enterprises was a major deterrent in borrowing through financial institutions (read more here). And our data agrees as well. Refer to the chart below.

Respondents could select more than one answer for this question. Each pie chart represents the percentage of respondents that choose a given option.

Ramesh, a tourism entrepreneur from Thamel, faced several financial hurdles trying to sustain his tourism business amidst the pandemic.

Read his full story here.

As we can see, only a small number of businesses could acquire loans with ease, with a big percentage finding the process difficult, or worse, not even able to get the financial assistance they need to keep their businesses alive.

There is a real need for making borrowing easier for small and medium-sized tourism businesses. Financial assistance from the government, easing of regulatory burdens, and smoother processes to borrow cash from banks and financial institutions (BFIs) can go a long way in helping support tourism businesses most in need. Similarly, policymakers should also consider making it easier for businesses to economically recover through consolidations, mergers, and acquisitions.

ESTABLISH TOURISM PROTECTION FUNDS

Finally, and most importantly, our data revealed that the pandemic has reared its ugliest head on small and medium-sized tourism businesses. It is high time policymakers pay heed to the nearly 7 out of 10 respondents who have demanded financial protection through the establishment of a tourism protection fund, and work towards formulating a mechanism that would help identify, prioritize, and support the tourism businesses’ that are in desperate need of financial assistance.